Prior to the pandemic, healthcare service delivery seemed unstoppable. Even in tough economic times, people always need healthcare, and there isn’t much that can disrupt the need for procedures, cancer treatments, etc. The job of a healthcare marketer seemed pretty unshakable. But here we are, in the midst of a global pandemic that has truly disrupted care delivery in the healthcare system and challenged healthcare marketers like nothing else that has come before.

To ascertain the effect of the pandemic on hospitals, health systems and healthcare marketing efforts, Greystone.Net began a series of research waves to analyze and understand the ongoing impact of the pandemic on healthcare marketing. We released the results of its first survey on the effects of the COVID-19 pandemic on healthcare marketing and marketers in May of 2020. The results from Wave 2 of the survey were recently released and illustrate how healthcare marketing is changing and evolving in the face of the viral pandemic.

COVID-19 continues to have a major impact on everyone. The US health system is still in disarray, struggling to maintain and perform traditional services. Patients remain reluctant in many cases to return to healthcare facilities in person, while providers struggle to protect their employees and patients. As a result, the 2020 marketing plans developed earlier in the year have been scrapped and new marketing plans and strategies are being developed and modified as conditions and rules change.

The top takeaways from Wave 2 of the survey include:

- Non-pandemic related healthcare marketing is making a comeback focused on a combination of primary and specialty care marketing.

- Nearly 90% of healthcare marketers are still working from home and it has remained at the same level since April.

- Good news: The percentage of healthcare marketers being furloughed is still relatively low. But travel is restricted and budgets are down. Most respondents expect budgets to decrease for the near future.

- Nearly all organizations are using social media to communicate with target audiences. We saw a big increase in digital advertising and PPC from April to June.

- Organizations either have or are working on revised marketing plans.

- The top goal for healthcare marketing right now is to communicate about safety for patients. Organizations are also focusing on stabilizing volume and profitability.

- Target audiences are deferred patients, specialty care, and those seeking elective surgery.

- Over 90% of respondents say they continue to market virtual visits and almost one-third say they are marketing this aggressively.

- Marketing messages are overwhelmingly focused on: safety, virtual visits and “we are open and rescheduling procedures.”

- Overall, organizations felt like they were prepared to handle the pandemic and despite the difficulties, they have seen some silver linings.

How the Survey Was Done

The survey looked at what has changed in healthcare marketing over the past several months. It was designed to collect information about the pandemic’s impact on hospital marketing and marketers and to better understand how marketers are adapting to the new imperatives, priorities and realities.

Conducted as part of Greystone Engage, Wave 2 of the survey was launched in June 2020. Results were compared to Wave 1 where appropriate. The survey respondents were 126 healthcare marketers from Greystone’s contact pool of provider organizations.

Demographics: Over one-third of respondents were academic medical centers (36%), followed by medium-size health systems (13%), large health systems and small health systems (both 11.7%) and children’s hospitals (6.5%). There was an even split of respondents who reported being in a “COVID-19 hot spot” versus those who were not (48% vs. 48%).

Details from the Survey

Current Marketing Focus

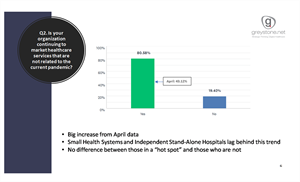

As might be expected, more organizations are marketing services not related to the pandemic than they were in April, up to 80% in May from 43% in April. The 80% was consistent between organizations located in a “hot spot” and those that were not. Small hospitals and stand-alone hospitals lag behind in this trend.

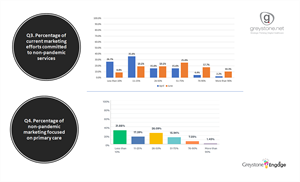

As states started to open up and providers moved to offering more of their regular services, a greater percent of healthcare marketing efforts are being devoted to non-pandemic services.  When asked what percentage of non-pandemic marketing efforts were devoted to primary care, the result was somewhat surprising, as about one-third of respondents reported devoting less than 10% of their non-pandemic marketing efforts to primary care. One-quarter of respondents reported devoting 26-50% of their non-pandemic efforts to primary care.

When asked what percentage of non-pandemic marketing efforts were devoted to primary care, the result was somewhat surprising, as about one-third of respondents reported devoting less than 10% of their non-pandemic marketing efforts to primary care. One-quarter of respondents reported devoting 26-50% of their non-pandemic efforts to primary care.

Focus of Work Activity

In April, 73.62% of survey respondents reported that >50% of their personal work activity was devoted to COVID-19 activities. In Wave 2 (June), that percentage dropped to 48.19% of respondents.

When the lockdowns began in late March, most marketing teams began to work remotely. In Wave 1 of the survey, 86.9% of respondents reported that they were primarily working remotely. That percentage remained the same in Wave 2, although there are reports of people alternating working from home and office or having split teams with some working remotely and some in the office.

Most hospital marketing teams have not been subjected to large-scale furloughs. About 80% of hospitals and health care systems say that furloughs have affected <10% of their staff. There was no significant variance in the data by type or size of organization.

Most organizations are experiencing travel restrictions due to the pandemic. Less than 10% of respondents reported no travel bans or restrictions at all, and most of those were small hospitals. Organizations located in “hot spots” were more likely to have a travel ban in place. 57% of respondents reported an indefinite travel ban in place at their organization, while 21% reported a ban through the end of 2020 and 7% through the end of their current fiscal year.

Almost 60% of respondents believe their budgets will decrease either slightly or significantly after the pandemic. Just over 7% believe their budgets will increase to some degree. Larger organizations expressed more pessimism about budgets decreasing – organizations with 1000+ beds expect a significant decrease in their budgets.

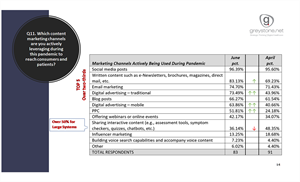

The top 5 channels being actively used to reach consumers and patients during the pandemic, as reported by over two-thirds of the respondents, remain the same from April:

- social media posts

- written content (e-Newsletters, brochures, magazine, direct mail, etc.)

- email marketing

- digital advertising – traditional

- blog posts.

All of these channels saw an increase of some degree since April. In addition, mobile digital advertising and PPC saw significant increases – 40.66% up to 64.86% and 24.18% up to 51.81%, respectively. Over 50% of larger hospital systems are using interactive content (assessment tools, symptom checkers, quizzes, chatbots, etc.) but as a group, use of this channel is down from April. However, a lot of the interactive content deployed earlier in the pandemic was COVID-related, so that may explain the overall decrease in use.

Most respondents (~70%) reported their organizations have established a post-COVID-19 recovery and strategic planning command center. There was no significant variance in the data by size or type of organization or proximity to a hot spot.

Almost 88% of respondents reported they had either already revised their 2020 marketing plan to make this adjustment or were in the process of doing so. Larger organizations were more likely to say “yes” to this question. Only 12% of respondents reported not yet revising their 2020 plan.

Looking Ahead

For the remainder of 2020, 92% of respondents report their primary marketing goal is restoring the public’s trust in their ability to provide a safe environment in their hospitals, physicians’ offices, etc., for health care. This includes providing clean facilities, healthy staff, plenty of PPE, robust hygiene standards, etc. Additional goals included stabilizing/driving volume to their physicians and services, stabilizing/driving profitability to the organization and stabilizing/driving volume to selected specific services.

Over 70% of respondents reported that their primary target audiences for the rest of 2020 are deferred patients (73.75%) and specialty care patients in select services – e.g., those services with capacity, readiness, high revenue, profitability, etc. (72.5%). To a lesser extent, they are also targeting primary care patients, current and prospective patients interested in virtual health and lapsed patients.

About 91% of organizations say they plan to continue marketing virtual visits, with almost 31% of those respondents saying they will market virtual visits aggressively and the remaining 60.5% saying they will market virtual visits as part of their marketing mix. Larger organizations (1000+ beds) are more likely to market virtual visits regardless of the marketing mix. The pandemic has no doubt served as a catalyst for moving virtual visits forward. Many marketers have reported that their earlier efforts to promote virtual visits often met with resistance, either from administrators or clinicians, but since the pandemic, there is more willingness to implement and use virtual visits.

The top messages reported by the survey respondents as being currently communicated in active campaigns were:

- safety of coming into hospital for surgery or a procedure (82.5%)

- safety of coming into a doctor’s office for an appointment or care (81.25%)

- promoting the using of virtual visits (81.25%)

- promoting rescheduling of elective procedures and services and promoting specialty care services (79%)

- promoting the use of primary care services (48.75%).

The top messages that survey respondents expect to convey for the remainder of 2020 were similar to those they are currently communicating:

- safety of coming into the doctor’s office for an appointment or care (87.5%)

- safety of coming into the hospital for surgery or a procedure (85%)

- promoting rescheduling of elective procedures and services (81.25%)

- promoting use of virtual visits (76.25%)

- promoting use of specialty care services (70%)

- promoting use of primary care services (60%).

- communicating about helping with cost-related questions and issues (25%).

The top activities reported being provided for employees as a result of the pandemic were expanding mental health services for frontline workers (73.75%), morale building exercises (55%), fundraising activities for employees or employee family members with COVID-19 (36.25%) and fundraising for the community in need – homeless, lost jobs, etc. (18.75%).

In retrospect, almost two-thirds of survey respondents said their organizations were very well prepared (17.5%) or well prepared (46.25%) to pivot their marketing messages during the pandemic. Only 10% said they were not prepared. This data is somewhat surprising, based on verbatim responses from Wave 1 in April (this question was not asked in this format in Wave 1), which indicated a considerable amount of negativity about how prepared organizations were to pivot messaging and react to the pandemic. Perhaps in reflecting back, the respondents realized they actually performed well under the circumstances.

When asked what signals they would be looking for to indicate that it is time to switch into pandemic marketing/communications mode, respondents gave these verbatim responses:

- Reported diagnosed cases

- Hospitalizations and ICU capacity

- Government/local experts and news

- Our clinical teams and leadership

- Networking/discussions with peers

- Death rate

When asked what silver linings they may have found as a result of the pandemic, respondents gave these verbatim responses:

- The adoption of virtual visits/telehealth

- Improved collaboration within the department and throughout the organization

- Improved productivity, particularly the speed at which decisions were made as compared to before the pandemic

- Recognition for Marketing/Communications/MarTech efforts

- Learning to work remotely

- Improved Marketing/Communication skills, including being cross-trained on new responsibilities

- Recognition for our hospital/health system

In closing:

The next survey Wave, which will be launched this fall, will most likely include these additional questions:

- Effectiveness of marketing messaging; how measured – data analytics

- Comparing internal utilization data pre- and post-COVID

- Has the positive feedback/recognition of hospitals during pandemic translated into better ratings on Google, Facebook, etc.?

- What outreach tactics for reaching out to delayed/deferred patients were the most common?

Wave 3 of the survey will continue to evaluate trends and also look at new and developing issues related to the pandemic.

Greystone is working with hospital clients to develop plans to support navigating and emerging from COVID-19.

- 12-step process to guide hospital and service re-openings and the associated marketing and communications tactics

- Rapid-fire, but a thorough, strategic process

Please feel free to connect with us if you’d like more information at info@greystone.net or 770-407-7670.